Case study

BANCO MUNDO MUJER

Banco Mundo Mujer,

is Colombia’s leading microcredit bank, focused on empowering independent workers and small business owners.

By Q3 2025, BMM ranked among the top 10 most profitable banks in the region.

PROFITS

$56.600 mill COP

Among the top 10 most profitable banks in Colombia.

ROE

25.6%

The bank with the 3rd highest ROE in Colombia.

This case study showcases the digital transformation driven by my area: Product.

As a leader, my main role was to define a clear roadmap and build effective methodologies to collaborate with the bank’s strategic teams.

As a specialist, I contributed to user research planning, UX/UI design, and the creation and management of the design system.

In doing so, we not only improved financial performance but also fostered creativity, innovation, agility, and a user-centered mindset across the entire organization.

Problem

In 2021, BMM needed to update its technological platforms (front and back office). This modernization was essential to stay competitive in the financial sector. One major challenge was the strong initial resistance — the bank had faced several failed transformation attempts, investing time, resources, and hope… yet seeing no results.

Strategic Challenges

- Manage internal cultural change throughout the digital transformation.

- Unify the digital experience across all channels.

- Optimize internal processes for greater efficiency and better service.

- Ensure full compliance with Colombian financial regulations on digital platforms.

- Bring BMM’s human and warm approach into the digital space.

- Develop a scalable technological architecture.

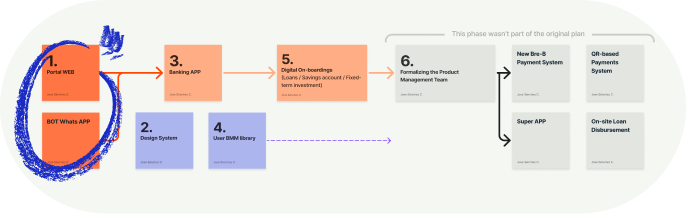

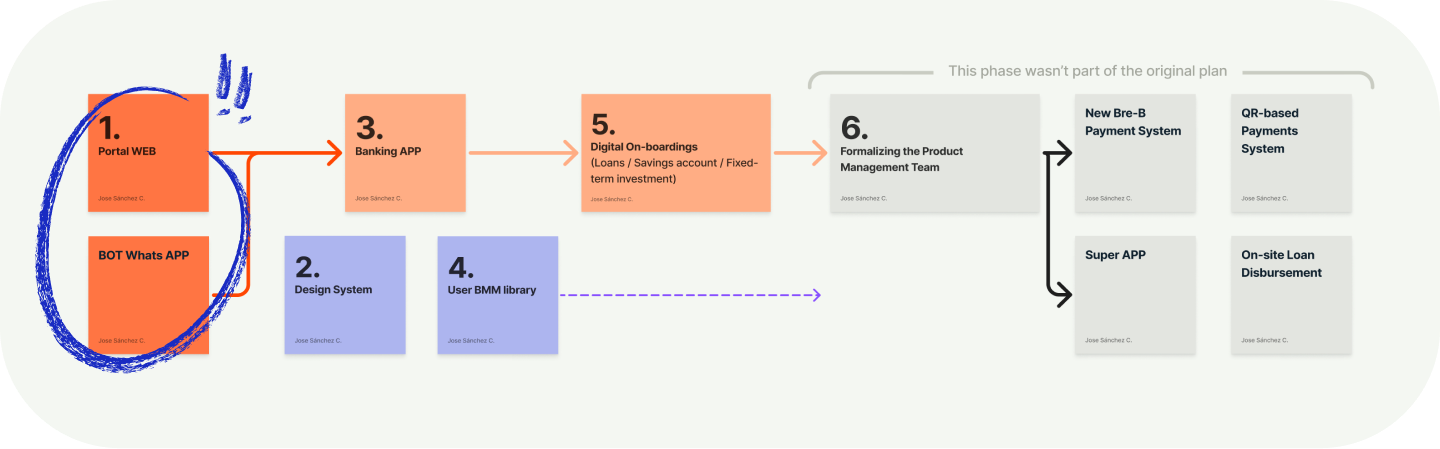

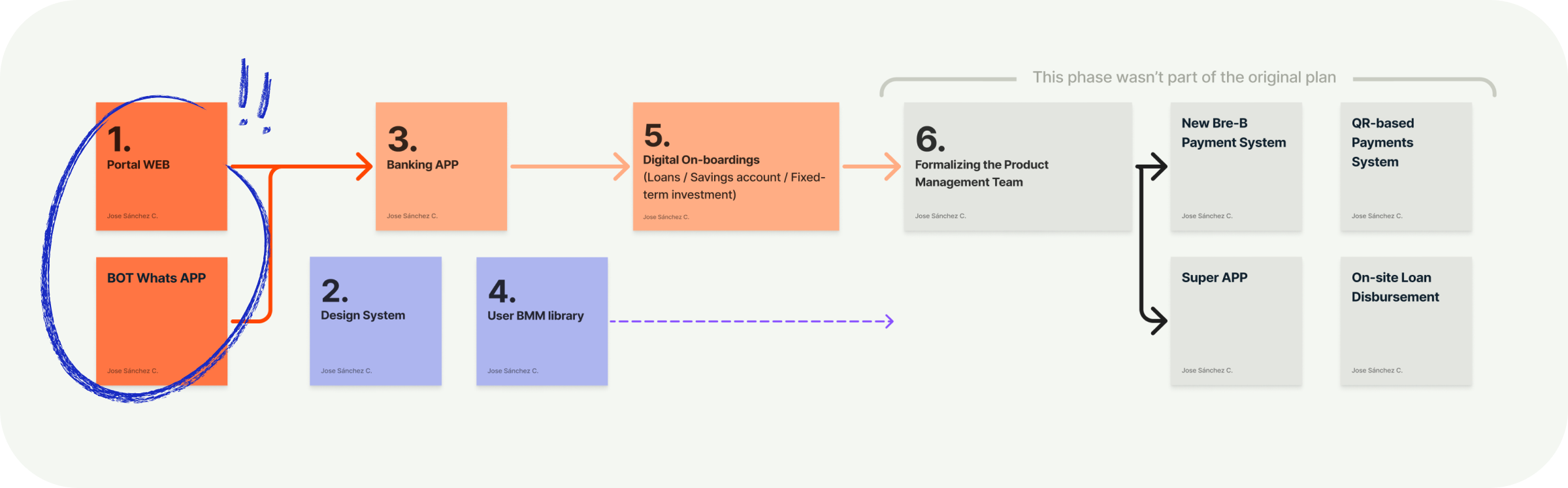

Strategy: Immediate Value

The main challenge here wasn’t technical — it was cultural. We needed to shift mindsets to achieve true digital transformation, and with that in mind, I developed my work plan.

It was necessary to take a modular, area-by-area approach — prioritizing the creation of trust through quick, visible wins that demonstrated immediate value to both users and stakeholders.

Portal web & WhatsApp

BMM initially proposed implementing a WhatsApp Bot; however, I prioritized updating the website as a strategic starting point for several reasons:

- It was ideal to get to know and understand our users — something never done before, and we needed that insight.

- It was visible to the entire organization, allowing us to demonstrate the value of our approach.

- It enabled me to connect with all key areas of the bank.

- We could define clear metrics to measure success and bring those “a-ha!” moments into key meetings.

- It was the perfect opportunity to begin building the Design System.

And while monthly visits increased by 400%, reaching 3,500 leads per month, the most important outcome was that we validated our approach and built trust.

It turned out that customers preferred WhatsApp over traditional forms, so we took the bot to the next level — integrating it as an alternative within the website’s lead generation journey. The result: 95% of users chose to continue through WhatsApp, and the drop-off rate decreased from 40% to 30%.

From 20k →

100.000

Monthly visits — 68% organic, whereas most were previously paid

New Leads

3500+

Monthly — previously, we only reached 500 per month.

Drop-off

30%

A WhatsApp button helped us reduce the drop-off rate from 40% to 30%.

Banking App Optimization

With these early wins, we won the bank’s heart! We gained enough independence to decide which challenges to tackle next — focusing on the banking app and the commercial platform, the core of BMM’s operations.

- We conducted user workshops to identify pain points and gains.

- We refined the design system based on our findings.

- We implemented key improvements that had an immediate impact on usability, effectiveness, and user satisfaction.

The BMM User (User Persona)

With all the previous inputs, we developed a detailed BMM user profile that served as:

- A key tool for co-creation workshops across different areas.

- A reference point to validate all product decisions.

- A unifying element that helped the entire organization understand who we were serving.

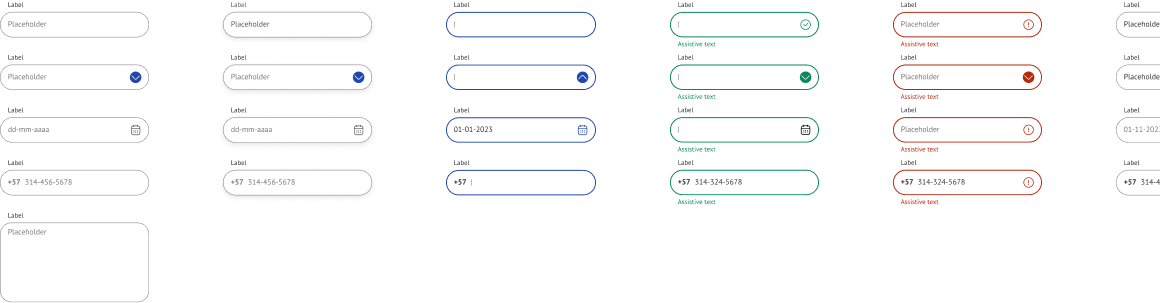

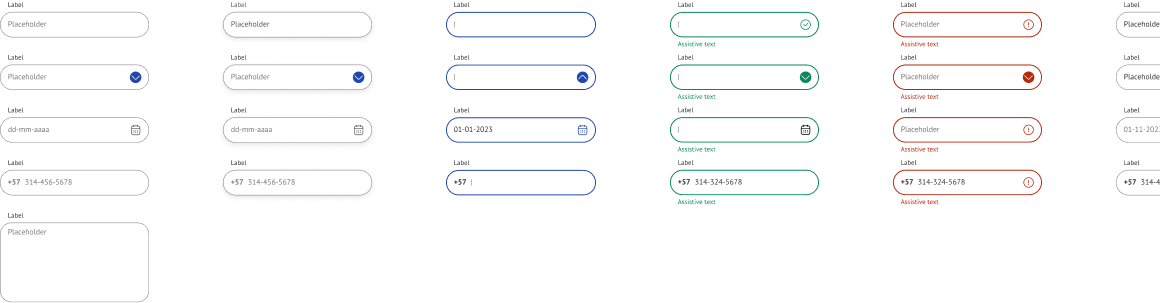

Design System y UX Library

Having led the creation of design systems in other companies, I knew that was the next step. We needed solid tools to build the foundation of our area. That’s why I proposed creating a base design system guided by the following principles:

- Consistency and modularity: coherent patterns, reusable components, and adaptation to the BMM user profile.

- Continuous learning: integrating past insights — for example, user tests revealed issues with input fields, so we redesigned them to be more intuitive and accessible.

- Scalability: easy to develop, with accessible resources (like PT Sans), minimalistic, and well-documented.

- Evolution: designed to grow over time, allowing updates and new versions without breaking existing structures.

- Accessibility: a non-negotiable must-have — at least AA+ compliance under WCAG 2.1.

- Identity and coherence: reflecting BMM’s renewed values and digital evolution.

- Voice and tone: including clear guidelines to maintain the bank’s distinctive personality across digital environments, with aligned content and microcopy standards.

This decision allowed the team to move faster in later projects, testing high-fidelity prototypes and validating ideas with agility.

Font family: PT Sans

Heading 1

Font size: 48px

Line height: 130%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing...

Heading 2

Font size: 36px

Line height: 130%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing, and texture before real content...

Heading 3

Font size: 28px

Line height: 150%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing, and texture before real content arrives.

Legacy Colors

700

#173279

500

#2047AB

300

#6A84C7

700

#A0792C

500

#C09234

300

#D3AC5F

New DSColors

700

#173279

500

#2047AB

300

#6A84C7

700

#E9B11B

500

#EDC149

300

#F0CB66

Inputs Collection

Digital Onboarding:Credit, Savings Account, Investment

With validated tools and methodologies, we tackled one of the bank’s most critical processes: onboarding financial products through digital channels. This cross-functional effort involved:

- Close collaboration with Legal, Compliance, and Risk teams to ensure secure processes aligned with Colombian regulations, including AML/CFT controls (SARLAFT in Colombia), data protection, and identity verification — all while maintaining a strong UX.

- Working with Legal and Marketing teams to apply Legal Design techniques effectively.

The Result:

We radically transformed the customer experience by reducing credit disbursement time from 2 hours to just 5 minutes, enabling savings account openings in under 1 minute, and offering instant investments.

Modular Infrastructure:

We developed a modular architecture:

- Reusable integrations across different products and services

- Flexible structure that enabled quick changes

- Clear standards to simplify future development

This modularity accelerated the creation of new features and optimized other processes in the branches, significantly improving the bank’s operational efficiency.

Consolidation:Product Management

The success of the previous stages allowed us to establish a formal Product Management area. With the trust we had gained, we were able to:

- Conduct workshops with commercial teams and key collaborators to turn their insights into products or new features.

- Promote the adoption of artificial intelligence by training teams and establishing practical use cases.

- Co-create with strategic areas ofthe bank: Legal, Compliance, Risk, and IT.

Thanks to the design system, thorough documentation, and user knowledge, we not only reduced risks but also cut product launch timelines from 1–2 years to just 4–8 months.

This strengthened position allowed us to participate in key innovations such as:

- QR Payments

- Bre-B Integration (New Colombia’s official instant payments)

- Field Credit Disbursement

- Commercial Platform Modernization

- International Remittances

Selecting initiatives guided by data and user insights

No longer based on hierarchical decisions or what the tech team happened to suggest.

Time to market

4-8 meses

When it used to take 1–2 years to bring any initiative to production.

TOOLS & STACK

Design & Research

Project Management & Analytics

Research, IA, Vibecoding

Financial and Authentication Providers

Outcomes

Clients

- Enjoy greater autonomy, now self-managing their products.

- Faster experience: account opening, investments, and credit in 5 minutes.

- Channels with AA+ accessibility.

- Clearer and more approachable communication.

- Increased trust; perceive the bank as modern and transparent.

- Greater security; consistent branding conveys higher quality and professionalism.

Business

- Higher operational efficiency: 94% reduction in credit disbursement time.

- Reduced TTM: products and features reach production in 4–8 months.

- Growth in business and improved client relationships.

- Increased usability across digital channels.

Organization

- Product Management area established as the core of innovation and agility.

- Strengthened collaboration across the bank’s strategic areas.

- New mindset: from resistance to change to confidence in digital transformation.

- User-centered design culture extended throughout the organization.

- Adoption of agile methodologies and collaborative work as operational standards.

- Progress toward an AI-First mindset, incorporating analytics and predictive insights into decision-making.

Key Takeaways

An effective digital transformation goes beyond technology — it integrates people, processes, and culture.

I witnessed an evolution that went beyond the digital. We restored something more valuable than code: trust. Not just in the technology, but in the bank’s ability to change without losing its essence.

We preserved the heart of the business: human relationships with independent workers and small business owners, often overlooked by traditional banking. Today, that transformation is felt in everyday experiences: in the client who understands how their credit works, the employee completing an operation in seconds, and the business owner receiving funding in minutes, all from home.

MORE READS

ARTICLE

The death of Coolors

And the rise of Claude

CASe STUDY

Banco Mundo Mujer

The region’s leading microfinance bank.

Ultraligero / JS © 2025. / Bogotá ✘ Remote

Case study

BANCO MUNDO MUJER

Banco Mundo Mujer,

is Colombia’s leading microcredit bank, focused on empowering independent workers and small business owners.

By Q3 2025, BMM ranked among the top 10 most profitable banks in the region.

PROFITS

$56.600mill COP

Among the top 10 most profitable banks in Colombia.

ROE

25.6%

The bank with the 3rd highest ROE in Colombia.

This case study showcases the digital transformation driven by my area: Product.

As a leader, my main role was to define a clear roadmap and build effective methodologies to collaborate with the bank’s strategic teams.

As a specialist, I contributed to user research planning, UX/UI design, and the creation and management of the design system.

In doing so, we not only improved financial performance but also fostered creativity, innovation, agility, and a user-centered mindset across the entire organization.

Problem

In 2021, BMM needed to update its technological platforms (front and back office). This modernization was essential to stay competitive in the financial sector. One major challenge was the strong initial resistance — the bank had faced several failed transformation attempts, investing time, resources, and hope… yet seeing no results.

Strategic Challenges

- Manage internal cultural change throughout the digital transformation.

- Unify the digital experience across all channels.

- Optimize internal processes for greater efficiency and better service.

- Ensure full compliance with Colombian financial regulations on digital platforms.

- Bring BMM’s human and warm approach into the digital space.

- Develop a scalable technological architecture.

Strategy: Immediate Value

The main challenge here wasn’t technical — it was cultural. We needed to shift mindsets to achieve true digital transformation, and with that in mind, I developed my work plan.

It was necessary to take a modular, area-by-area approach — prioritizing the creation of trust through quick, visible wins that demonstrated immediate value to both users and stakeholders.

Portal web & WhatsApp

BMM initially proposed implementing a WhatsApp Bot; however, I prioritized updating the website as a strategic starting point for several reasons:

- It was ideal to get to know and understand our users — something never done before, and we needed that insight.

- It was visible to the entire organization, allowing us to demonstrate the value of our approach.

- It enabled me to connect with all key areas of the bank.

- We could define clear metrics to measure success and bring those “a-ha!” moments into key meetings.

- It was the perfect opportunity to begin building the Design System.

And while monthly visits increased by 400%, reaching 3,500 leads per month, the most important outcome was that we validated our approach and built trust.

It turned out that customers preferred WhatsApp over traditional forms, so we took the bot to the next level — integrating it as an alternative within the website’s lead generation journey. The result: 95% of users chose to continue through WhatsApp, and the drop-off rate decreased from 40% to 30%.

From 20k →

100.000

Monthly visits — 68% organic, whereas most were previously paid

New Leads

3500+

Monthly — previously, we only reached 500 per month.

Drop-off

30%

A WhatsApp button helped us reduce the drop-off rate from 40% to 30%.

Banking App Optimization

With these early wins, we won the bank’s heart! We gained enough independence to decide which challenges to tackle next — focusing on the banking app and the commercial platform, the core of BMM’s operations.

- We conducted user workshops to identify pain points and gains.

- We refined the design system based on our findings.

- We implemented key improvements that had an immediate impact on usability, effectiveness, and user satisfaction.

The BMM User (User Persona)

With all the previous inputs, we developed a detailed BMM user profile that served as:

- A key tool for co-creation workshops across different areas.

- A reference point to validate all product decisions.

- A unifying element that helped the entire organization understand who we were serving.

Design System y UX Library

Having led the creation of design systems in other companies, I knew that was the next step. We needed solid tools to build the foundation of our area. That’s why I proposed creating a base design system guided by the following principles:

- Consistency and modularity: coherent patterns, reusable components, and adaptation to the BMM user profile.

- Continuous learning: integrating past insights — for example, user tests revealed issues with input fields, so we redesigned them to be more intuitive and accessible.

- Scalability: easy to develop, with accessible resources (like PT Sans), minimalistic, and well-documented.

- Evolution: designed to grow over time, allowing updates and new versions without breaking existing structures.

- Accessibility: a non-negotiable must-have — at least AA+ compliance under WCAG 2.1.

- Identity and coherence: reflecting BMM’s renewed values and digital evolution.

- Voice and tone: including clear guidelines to maintain the bank’s distinctive personality across digital environments, with aligned content and microcopy standards.

This decision allowed the team to move faster in later projects, testing high-fidelity prototypes and validating ideas with agility.

Font family: PT Sans

Heading 1

Font size: 48px

Line height: 130%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing...

Heading 2

Font size: 36px

Line height: 130%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing, and texture before real content...

Heading 3

Font size: 28px

Line height: 150%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing, and texture before real content arrives.

Legacy Colors

700

#173279

500

#2047AB

300

#6A84C7

700

#A0792C

500

#C09234

300

#D3AC5F

New DSColors

700

#173279

500

#2047AB

300

#6A84C7

700

#E9B11B

500

#EDC149

300

#F0CB66

Inputs Collection

Digital Onboarding:Credit, Savings Account, Investment

With validated tools and methodologies, we tackled one of the bank’s most critical processes: onboarding financial products through digital channels. This cross-functional effort involved:

- Close collaboration with Legal, Compliance, and Risk teams to ensure secure processes aligned with Colombian regulations, including AML/CFT controls (SARLAFT in Colombia), data protection, and identity verification — all while maintaining a strong UX.

- Working with Legal and Marketing teams to apply Legal Design techniques effectively.

The Result:

We radically transformed the customer experience by reducing credit disbursement time from 2 hours to just 5 minutes, enabling savings account openings in under 1 minute, and offering instant investments.

Modular Infrastructure:

We developed a modular architecture:

- Reusable integrations across different products and services

- Flexible structure that enabled quick changes

- Clear standards to simplify future development

This modularity accelerated the creation of new features and optimized other processes in the branches, significantly improving the bank’s operational efficiency.

Consolidation:Product Management

The success of the previous stages allowed us to establish a formal Product Management area. With the trust we had gained, we were able to:

- Conduct workshops with commercial teams and key collaborators to turn their insights into products or new features.

- Promote the adoption of artificial intelligence by training teams and establishing practical use cases.

- Co-create with strategic areas ofthe bank: Legal, Compliance, Risk, and IT.

Thanks to the design system, thorough documentation, and user knowledge, we not only reduced risks but also cut product launch timelines from 1–2 years to just 4–8 months.

This strengthened position allowed us to participate in key innovations such as:

- QR Payments

- Bre-B Integration (New Colombia’s official instant payments)

- Field Credit Disbursement

- Commercial Platform Modernization

- International Remittances

Selecting initiatives guided by data and user insights

No longer based on hierarchical decisions or what the tech team happened to suggest.

Time to market

4-8 meses

When it used to take 1–2 years to bring any initiative to production.

Tools & Stack

Design & Research

Project Management & Analytics

Research, IA, Vibecoding

Financial and Authentication Providers

Outcomes

Clients

- Enjoy greater autonomy, now self-managing their products.

- Faster experience: account opening, investments, and credit in 5 minutes.

- Channels with AA+ accessibility.

- Clearer and more approachable communication.

- Increased trust; perceive the bank as modern and transparent.

- Greater security; consistent branding conveys higher quality and professionalism.

Business

- Higher operational efficiency: 94% reduction in credit disbursement time.

- Reduced TTM: products and features reach production in 4–8 months.

- Growth in business and improved client relationships.

- Increased usability across digital channels.

Organization

- Product Management area established as the core of innovation and agility.

- Strengthened collaboration across the bank’s strategic areas.

- New mindset: from resistance to change to confidence in digital transformation.

- User-centered design culture extended throughout the organization.

- Adoption of agile methodologies and collaborative work as operational standards.

- Progress toward an AI-First mindset, incorporating analytics and predictive insights into decision-making.

Key Takeaways

An effective digital transformation goes beyond technology — it integrates people, processes, and culture.

I witnessed an evolution that went beyond the digital. We restored something more valuable than code: trust. Not just in the technology, but in the bank’s ability to change without losing its essence.

We preserved the heart of the business: human relationships with independent workers and small business owners, often overlooked by traditional banking. Today, that transformation is felt in everyday experiences: in the client who understands how their credit works, the employee completing an operation in seconds, and the business owner receiving funding in minutes, all from home.

MORE READS

ARTICLE

The death of Coolors

And the rise of Claude

CASe STUDY

Banco Mundo Mujer

The region’s leading microfinance bank.

Ultraligero / JS © 2025. / Bogotá ✘ Remote

Case study

BANCO MUNDO MUJER

Banco Mundo Mujer,

is Colombia’s leading microcredit bank, focused on empowering independent workers and small business owners.

By Q3 2025, BMM ranked among the top 10 most profitable banks in the region.

PROFITS

$56.600 mill COP

Among the top 10 most profitable banks in Colombia.

ROE

25.6%

The bank with the 3rd highest ROE in Colombia.

This case study showcases the digital transformation driven by my area: Product.

As a leader, my main role was to define a clear roadmap and build effective methodologies to collaborate with the bank’s strategic teams.

As a specialist, I contributed to user research planning, UX/UI design, and the creation and management of the design system.

In doing so, we not only improved financial performance but also fostered creativity, innovation, agility, and a user-centered mindset across the entire organization.

Problem

In 2021, BMM needed to update its technological platforms (front and back office). This modernization was essential to stay competitive in the financial sector. One major challenge was the strong initial resistance — the bank had faced several failed transformation attempts, investing time, resources, and hope… yet seeing no results.

Strategic Challenges

- Manage internal cultural change throughout the digital transformation.

- Unify the digital experience across all channels.

- Optimize internal processes for greater efficiency and better service.

- Ensure full compliance with Colombian financial regulations on digital platforms.

- Bring BMM’s human and warm approach into the digital space.

- Develop a scalable technological architecture.

Strategy: Immediate Value

The main challenge here wasn’t technical — it was cultural. We needed to shift mindsets to achieve true digital transformation, and with that in mind, I developed my work plan.

It was necessary to take a modular, area-by-area approach — prioritizing the creation of trust through quick, visible wins that demonstrated immediate value to both users and stakeholders.

Portal web & WhatsApp

BMM initially proposed implementing a WhatsApp Bot; however, I prioritized updating the website as a strategic starting point for several reasons:

- It was ideal to get to know and understand our users — something never done before, and we needed that insight.

- It was visible to the entire organization, allowing us to demonstrate the value of our approach.

- It enabled me to connect with all key areas of the bank.

- We could define clear metrics to measure success and bring those “a-ha!” moments into key meetings.

- It was the perfect opportunity to begin building the Design System.

And while monthly visits increased by 400%, reaching 3,500 leads per month, the most important outcome was that we validated our approach and built trust.

It turned out that customers preferred WhatsApp over traditional forms, so we took the bot to the next level — integrating it as an alternative within the website’s lead generation journey. The result: 95% of users chose to continue through WhatsApp, and the drop-off rate decreased from 40% to 30%.

From 20k →

100.000

Monthly visits — 68% organic, whereas most were previously paid

New Leads

3500+

Monthly — previously, we only reached 500 per month.

Drop-off

30%

A WhatsApp button helped us reduce the drop-off rate from 40% to 30%.

Banking App Optimization

With these early wins, we won the bank’s heart! We gained enough independence to decide which challenges to tackle next — focusing on the banking app and the commercial platform, the core of BMM’s operations.

- We conducted user workshops to identify pain points and gains.

- We refined the design system based on our findings.

- We implemented key improvements that had an immediate impact on usability, effectiveness, and user satisfaction.

The BMM User (User Persona)

With all the previous inputs, we developed a detailed BMM user profile that served as:

- A key tool for co-creation workshops across different areas.

- A reference point to validate all product decisions.

- A unifying element that helped the entire organization understand who we were serving.

Design System y UX Library

Having led the creation of design systems in other companies, I knew that was the next step. We needed solid tools to build the foundation of our area. That’s why I proposed creating a base design system guided by the following principles:

- Scalability: easy to develop, with accessible resources (like PT Sans), minimalistic, and well-documented.

- Identity and coherence: reflecting BMM’s renewed values and digital evolution.

- Consistency and modularity: coherent patterns, reusable components, and adaptation to the BMM user profile.

- Evolution: designed to grow over time, allowing updates and new versions without breaking existing structures.

- Accessibility: a non-negotiable must-have — at least AA+ compliance under WCAG 2.1.

- Voice and tone: including clear guidelines to maintain the bank’s distinctive personality across digital environments, with aligned content and microcopy standards.

- Continuous learning: integrating past insights — for example, user tests revealed issues with input fields, so we redesigned them to be more intuitive and accessible.

This decision allowed the team to move faster in later projects, testing high-fidelity prototypes and validating ideas with agility.

Font family: PT Sans

Heading 1

Font size: 48px

Line height: 130%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing...

Heading 2

Font size: 36px

Line height: 130%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing, and texture before real content...

Heading 3

Font size: 28px

Line height: 150%

Design is the balance between clarity and emotion. This dummy text is used to visualize type hierarchy, spacing, and texture before real content arrives.

Legacy Colors

700

#173279

500

#2047AB

300

#6A84C7

700

#A0792C

500

#C09234

300

#D3AC5F

New DSColors

700

#173279

500

#2047AB

300

#6A84C7

700

#E9B11B

500

#EDC149

300

#F0CB66

Inputs Collection

Digital Onboarding:Credit, Savings Account, Investment

With validated tools and methodologies, we tackled one of the bank’s most critical processes: onboarding financial products through digital channels. This cross-functional effort involved:

- Close collaboration with Legal, Compliance, and Risk teams to ensure secure processes aligned with Colombian regulations, including AML/CFT controls (SARLAFT in Colombia), data protection, and identity verification — all while maintaining a strong UX.

- Working with Legal and Marketing teams to apply Legal Design techniques effectively.

The Result:

We radically transformed the customer experience by reducing credit disbursement time from 2 hours to just 5 minutes, enabling savings account openings in under 1 minute, and offering instant investments.

Modular Infrastructure:

We developed a modular architecture:

- Reusable integrations across different products and services

- Flexible structure that enabled quick changes

- Clear standards to simplify future development

This modularity accelerated the creation of new features and optimized other processes in the branches, significantly improving the bank’s operational efficiency.

Consolidation:Product Management

The success of the previous stages allowed us to establish a formal Product Management area. With the trust we had gained, we were able to:

- Conduct workshops with commercial teams and key collaborators to turn their insights into products or new features.

- Promote the adoption of artificial intelligence by training teams and establishing practical use cases.

- Co-create with strategic areas ofthe bank: Legal, Compliance, Risk, and IT.

Thanks to the design system, thorough documentation, and user knowledge, we not only reduced risks but also cut product launch timelines from 1–2 years to just 4–8 months.

This strengthened position allowed us to participate in key innovations such as:

- QR Payments

- Bre-B Integration (New Colombia’s official instant payments)

- Field Credit Disbursement

- Commercial Platform Modernization

- International Remittances

Selecting initiatives guided by data and user insights

No longer based on hierarchical decisions or what the tech team happened to suggest.

Time to market

4-8 meses

When it used to take 1–2 years to bring any initiative to production.

TOOLS & STACK

Design & Research

Project Management & Analytics

Research, IA, Vibecoding

Financial and Authentication Providers

Outcomes

Clients

- Enjoy greater autonomy, now self-managing their products.

- Faster experience: account opening, investments, and credit in 5 minutes.

- Channels with AA+ accessibility.

- Clearer and more approachable communication.

- Increased trust; perceive the bank as modern and transparent.

- Greater security; consistent branding conveys higher quality and professionalism.

Business

- Higher operational efficiency: 94% reduction in credit disbursement time.

- Reduced TTM: products and features reach production in 4–8 months.

- Growth in business and improved client relationships.

- Increased usability across digital channels.

Organization

- Product Management area established as the core of innovation and agility.

- Strengthened collaboration across the bank’s strategic areas.

- New mindset: from resistance to change to confidence in digital transformation.

- User-centered design culture extended throughout the organization.

- Adoption of agile methodologies and collaborative work as operational standards.

- Progress toward an AI-First mindset, incorporating analytics and predictive insights into decision-making.

Key Takeaways

An effective digital transformation goes beyond technology — it integrates people, processes, and culture.

I witnessed an evolution that went beyond the digital. We restored something more valuable than code: trust. Not just in the technology, but in the bank’s ability to change without losing its essence.

We preserved the heart of the business: human relationships with independent workers and small business owners, often overlooked by traditional banking. Today, that transformation is felt in everyday experiences: in the client who understands how their credit works, the employee completing an operation in seconds, and the business owner receiving funding in minutes, all from home.

MORE READS

ARTICLE

The death of Coolors

And the rise of Claude

CASe STUDY

Banco Mundo Mujer

The region’s leading microfinance bank.

Ultraligero / JS © 2025. / Bogotá ✘ Remote